The Benefits of On Platform Cloud Payroll Software

When moving to NetSuite, most companies already have a payroll solution in place that the team and business is comfortable with. In an effort to simplify their implementation, many companies choose to delay implementing Infinet Cloud Payroll, which is the leading on platform payroll solution for NetSuite.

Whilst this is a good strategy to ensure your initial implementation is focussed and streamlined, some businesses put off revisiting this essential component of their businesses software ecosystem which can lead to siloed information and lack of visibility and transparency. It can also create additional workload for the payroll team when it comes to uploading payroll journals to NetSuite and reporting figures, such as single touch payroll data, back to the ATO.

If you are a NetSuite customer, and are not running Infinet Cloud Payroll, then read on to learn more about what TeamBlueSky's customers report as the biggest benefits to bringing your payroll process onto NetSuite.

What is Cloud Based Payroll Software?

Cloud payroll software is a payroll management solution that allows businesses to automate their payroll processes and manage employee data in one centralised system. Cloud payroll systems are available on a subscription basis, and can be accessed via the internet from any location.

Ease of Use

All the information your payroll team needs is available in one place, within NetSuite. This means that your team can access employee data, tax file numbers, leave balances and superannuation details and update employee records without ever having to leave the NetSuite interface.

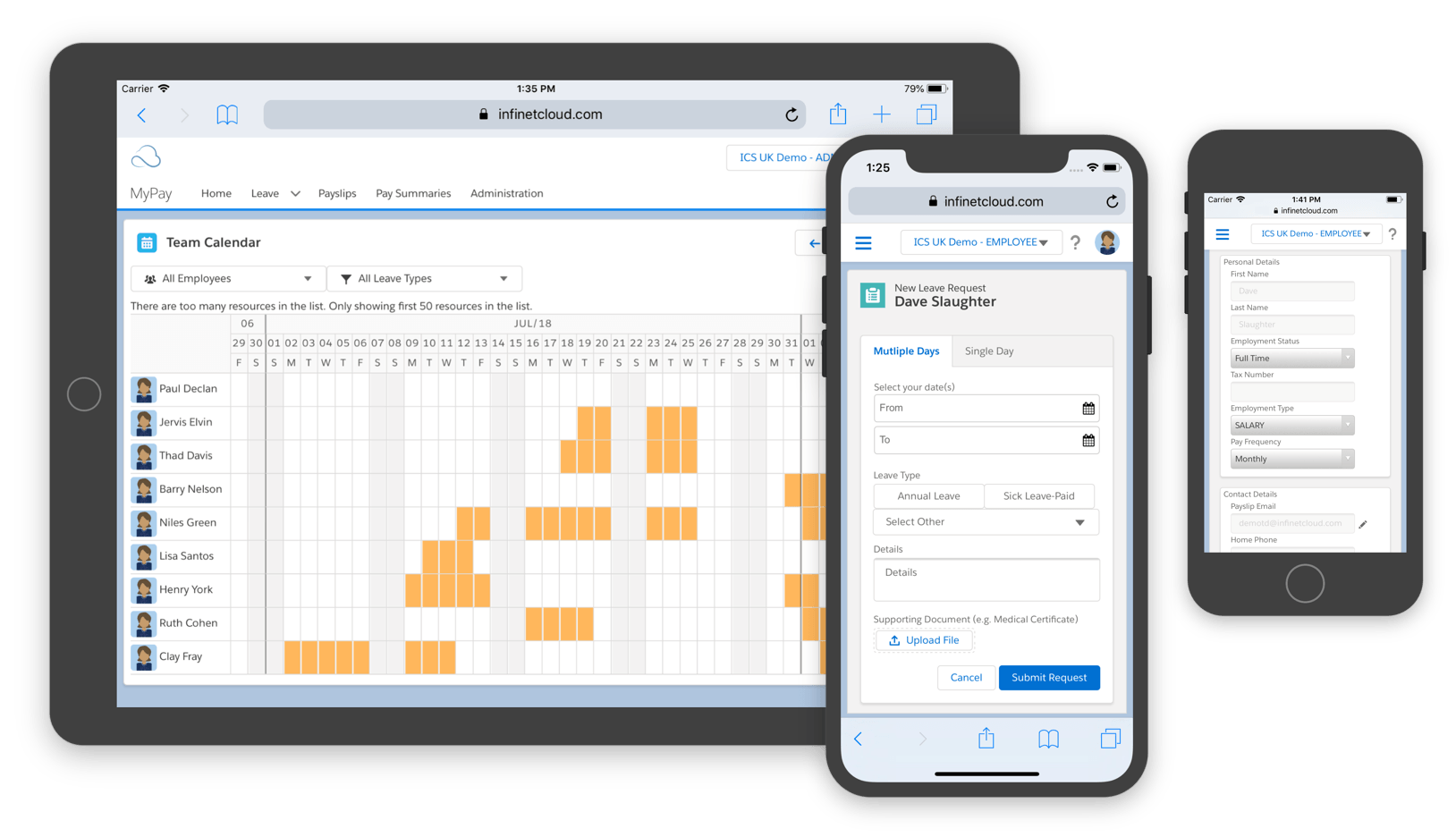

Self Service Portals

ICS Payroll also offers a self-service portal for employees, so they can update their personal details and request leave without needing to contact the payroll team. This reduces the workload for your payroll team, and ensures that your employee data is always up-to-date.

Time Savings

ICS Payroll integrates with other NetSuite modules, such as time tracking and expense management. This means that your payroll team can save time by retrieving employee time sheets and expense claims directly into the Cloud Payroll module. This reduces the amount of data entry required, and ensures that all employee data is accurate.

Increased Visibility

ICS Payroll offers increased visibility into your payroll process. The Cloud Payroll dashboard provides an overview of your payroll data, including employee leave balances, superannuation details and tax information. This allows you to quickly identify any areas that may require attention, and ensures that your payroll process is running smoothly.

Improved Accuracy

ICS Payroll offers a number of features that help to improve the accuracy of your payroll data. The Cloud Payroll system can automatically calculate leave entitlements, superannuation contributions and tax deductions, based on employee data. This reduces the chance of errors, and ensures that your payroll process is compliant with the latest legislations.

Low Upfront Costs

Cloud Payroll systems are available on a subscription basis, which means that there are minimal upfront costs. This makes cloud based payroll an affordable solution for businesses of all sizes.

Why Choose Infinet Cloud Payroll?

Infinet Cloud Payroll is the leading on-platform payroll solution for NetSuite. Infinet Cloud offers a number of features that make it the ideal choice for businesses running NetSuite.

A single, unified platform for managing payroll, time and attendance, and human resources

NetSuite's and ICP's single, unified platform for managing payroll, time and attendance, and human resources makes it easy to manage your entire workforce from a single system. With Infinet Cloud for NetSuite, you can streamline your payroll processes, improve decision-making, and optimise your workforce management.

Seamless integration with NetSuite accounting and financials

ICS payroll integrates seamlessly with NetSuite accounting and financials, providing you with a complete view of your payroll data in one place. With this integration, you can streamline your financial reporting and improve decision-making across your business.

A wide range of built-in reports and customisable dashboards

ICS payroll offers a wide range of built-in reports and customisable dashboards, giving you a complete view of your payroll data. You can easily create custom reports to meet your specific needs, and configure your dashboards to give you the information you need at a glance.

Robust security and compliance features

ICS payroll is fully compliant with all relevant payroll regulations and guidelines and is one of the few systems able to provide their customer base with fully compliant single touch reporting within the planned time frame.

Excellent customer support

ICS Payroll also offers excellent customer support, with local Australian staff available to help you with any system questions or issues you may have. You will also have access to payroll experts to ensure any problems or support requests are managed quickly and efficiently.

Key Features of Infinet Cloud Payroll for NetSuite

Configurable Employee Pay Components

Infinet Cloud caters for all types of allowances, deductions, salary sacrifice, commissions and bonuses. Enter these as one offs or if they are a regular payment (e.g. quarterly bonuses or commissions) add as a variable pay component at the individual employee level, allowing them to flow into the pay run with only an amount required to be entered. You also have the flexibility to alter the paid for period for taxation variation as per ATO rules. e.g. Paying a quarterly bonus within a weekly pay run.

Below are examples of some of the most common pay components, however you have the flexibility to create your own as required;

Manage Allowances

LAFHA, Car Allowance, On Call, Tools etc.

Set Up Employee Salary and Wage Components

Commissions, Bonuses, Overtime.

Automate Deductions

Child Support, Union Fees, Superannuation, Healthcare Funds.

Manage Salary Sacrifice

Laptops, Novated Lease, Superannuation, Fringe Benefit, Exempt Benefit.

Calculate Tax

Flat and progressive rates, Manual PAYG/PAYE (catering for reductions, additions or override percentages)

Employee Self Service for NetSuite

Granular Access Management

Manage employee access from the employee record, secure access via HTTPS using 128 Bit Encryption.

Automate Payslips and Pay Summaries Creation and Distribution

Allow employees to view and access their payslips online. Each payslip and pay summary is available in PDF format and all previous documents are stored and available historically.

Self Serve Options to Manage Bank Accounts

Employees can create and update their own bank account details, specifying a primary account, and up to two secondary accounts. Payment can be split across the accounts as desired.

Simplify Leave Management Requests

Employees can review their leave calendar and statutory holidays for their region. Employees can view their accrued and available leave for annual, personal and long service leave. Employees can make requests, calculating the required leave based on the employee’s working week, and statutory holiday. If leave is for a future period, available leave will be forecast based on accrual.

Pay Run Management

Create Pay Types

Support for both Salaried (employee paid a base salary) and Waged (employee paid based on the hours they work).

Set Up Multiple Pay Frequencies

Manage multiple pay frequencies in your organisation with the ability to support weekly, fortnightly and monthly pay runs. Further filter your pay run by employee settings including department, class, location, pay date and country.

Easy To Use Process Workflows

Simple step based process takes you through selection, time entry, variable entry, processing, and pay through to posting. At each step data is presented cleanly to ensure focused timely completion.

Make Adjustments and Corrections to Pay Runs

Quite often adjustments need to be made to reflect corrections, or payments of one offs outside of the normal pay run. These can be easily achieved with an adjustment pay run, offering options as to whether leave should be accrued, and whether tax calculations should take into account other payslips within the period.

Automate Payroll Processing for Simple Payroll Cycles

For companies running payroll with minimal variations, automate the process between steps using Autopay. Select your start and end step and Autopay will complete the process in the background, sending you an email on completion.

Comprehensive Rollback Management

Full capability to rollback any payrun; from and to any stage. Rollback ensures all records are rolled back and year to date fields are recalculated. This means that your system will manage all adjustments on the accounting and financial side of things, so no need to update two different systems and audit the changes for accuracy.

Can You Outsource Your Payroll with Infinet Cloud?

Yes! TeamBlueSky offers a turnkey outsourced payroll management option for our clients. We can take care of implementing the solution, setting up your pay runs, employee records, pay rules and take responsibility for the day to day management of your businesses payroll, whether you have a small team or are a large enterprise. We will work with you to ensure a seamless transition to the Cloud and provide ongoing training and support as required. Our Cloud Payroll solution is flexible and can be tailored to meet the specific needs of your business.

Interested in Learning More?

If you are a NetSuite customer who is not running Cloud Payroll, we recommend that you speak to our team about the benefits of moving to Cloud Payroll. TeamBlueSky are Infinet Cloud Payroll experts. For over 10 years we have been helping NetSuite customers to streamline and consolidate their software platforms and can help you to streamline your payroll process. If you are interested in learning more about Infinet Cloud Payroll, getting a demonstration of the solution or discussing your payroll implementation requirements then contact us today.

Henry Sack

General Manager

With over 12 years of experience as a NetSuite implementation consultant, Henry Sack leads TeamBlueSky’s team of NetSuite and accounting experts in his role of General Manager.

TeamBlueSky is a leading Australian

NetSuite Alliance Partner whose mission is to provide critical

NetSuite BPO and

Payroll services to NetSuite clients who are wanting to simplify their

back office processes and partner with a leading

NetSuite administration expert.

TeamBlueSky have also partnered with global Suite Developer Network partners to offer local solutioning, implementation and support services for global NetSuite SuiteApps.