What is AP Automation and How Does It Work With NetSuite? 2022 Update

Many of the NetSuite client’s that we work with are looking for ways to make better use of NetSuite and continue to improve their system to increase efficiency and automate time consuming or repetitive tasks. This is referred to as AP Automation, which allows the NetSuite administrator to automate tasks without writing any code or customizing forms. To help support this request for further automation, NetSuite offers some workflow functionality, however the features for true AP automation at limited.

If you’re new to the world of an enterprise level cloud system, then there are several articles that we have written for you below which highlight key issues that our clients have asked us during our time working with teams on the implementation.

Can NetSuite Do AP Automation Natively ?

The short answer is no. Whilst NetSuite is an outstanding accounting platform, there is no native functionality that allows users to fully automate their AP process. For the majority of NetSuite customers, the traditional approach to AP administration remains in place, where finance team members take responsibility for collecting, organising, keying-in, PO matching, delivery docket matching and once approved, downloading the bank file from NetSuite, and uploading to their online banking system for manual payment.

The AP workflow is extremely manual and time-consuming. In addition to this, NetSuite doesn’t allow users to generate official bank reconciliation reports from within the system. Furthermore, a busy Accounts Payable team can lead to slow response times impact on cash flow which leads to supplier invoice late payment penalties.

How Do Our Customers Implement AP Automation?

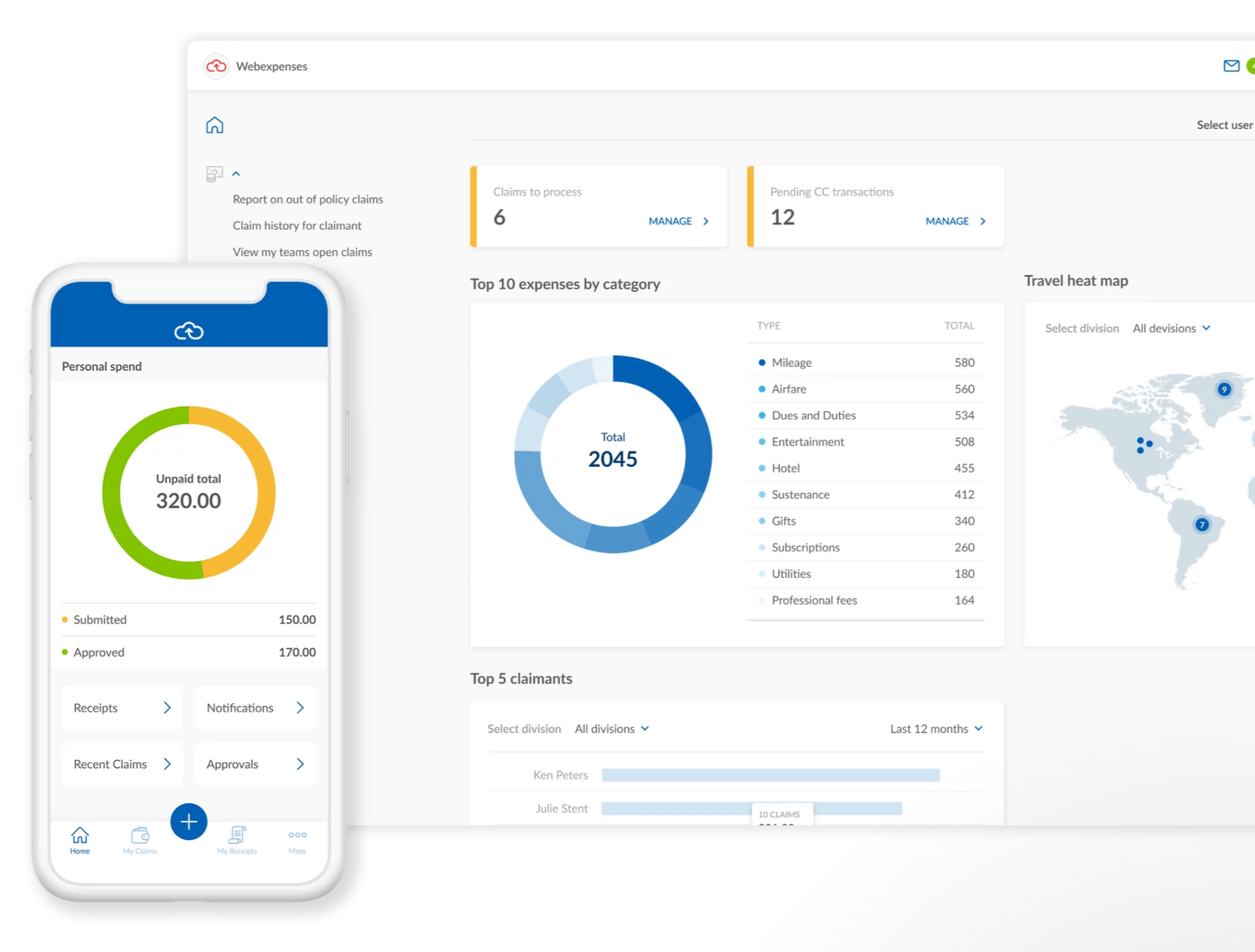

In order to improve the current situation there are a number of things that you can do. One of the most effective methods is to invest in an AP automation system, such as Webexpenses, which allows NetSuite users to streamline and automate their invoicing and payment reconciliation process.

Webexpenses automates the entire invoice process, from receipt through to payment – all within the NetSuite solution.

AP automation solutions seek to streamline this process by using modern OCR (Optical Character Recognition) and ICR (Intelligent Character Recognition) to automatically receive, interpret and match inbound invoices to transactions that exist in NetSuite and then through workflows, send the invoice to the relevant approver.

The major benefits of AP Automation technology are:

Reduction in Paperwork

One of the key benefits of implementing an AP Automation solution is the reduction in paperwork. This is achieved as the system automatically receives, interprets and matches inbound invoices to transactions that exist in NetSuite. This means that there is no need for finance team members to spend time keying-in invoices or matching them to purchase orders. In addition, the use of OCR (Optical Character Recognition) and ICR (Intelligent Character Recognition) means that the system can automatically read and interpret invoices, removing any need for manual input.

Easier Reconciliation

Automating AP is also beneficial from a reconciliation standpoint. With an AP automation system in place, it is much easier to reconcile invoices against payments as the system will have automatically matched them up. This means that there is less chance for human error, and eliminates the need for time-consuming manual reconciliations.

Improved Cash Flow

AP Automation also has a positive impact on cash flow. With less time spent on manual tasks, finance team members are able to focus on more important activities, such as ensuring that invoices are paid on time and that there is no build-up of debt. In addition, the use of AP automation technology can help to improve supplier relationships, as suppliers are less likely to experience late payment penalties.

Reduced Late Invoice Penalties

Late invoice penalties can have a detrimental impact on supplier relationships. Not only can they lead to higher costs, but they can also damage the supplier's credit rating, making it more difficult for them to obtain future credit. This can be costly for the business relationships.

Increased Visibility of Expenditure

AP automation systems also provide increased visibility of expenditure. This is because the system will create an audit trail of all invoices processed, from receipt through to payment. This means that it is much easier to track and monitor spending, and helps to ensure that budgets are adhered to. In addition, it provides a valuable insight into areas where cost savings could be made.

Identify Trends Through Better Data Analysis

The benefits of AP Automation technology not only impact the finance team, but also have a positive impact on the business as a whole. The use of AP automation systems can help to improve visibility of expenditure, allowing businesses to identify trends and make better-informed decisions about where they can make savings.

Streamlined Administration & AP Data Entry

AP Automation is also beneficial for the finance department as it streamlines administration and reduces data entry. The system does this by automatically receiving, interpreting and matching inbound invoices to transactions that exist in NetSuite. This means that there is no need for finance team members to spend time keying-in invoices or matching them

Reduced Human Errors

The use of AP automation systems reduces the chance of human error, as there is no need for finance team members to spend time keying-in invoices or matching them with purchase orders. The system instead uses Optical Character Recognition (OCR) and Intelligent Character Recognition (ICR) to automatically read and interpret invoices

Time Savings for the Finance Team

The use of AP automation systems saves time for finance team members, who can instead focus on more important activities such as ensuring that invoices are paid on time and that there is no build-up of debt.

Improved Relationships with Suppliers

Reduced supplier complaints has a positive impact on supplier relationships. Not only can poor relations lead to higher costs, but they can also affect how willing a client is to continue working with your business.

How Does Accounts Payable Automation Work?

AP Automation solutions, such as Webexpenses use intelligent technology to read, and digitise data that is contained in an vendor bill, whether in electronic format (PDF) or scanned from a physical paper bill. This data is then matched with relevant transactions in NetSuite, through a number of different factors such as PO number, dates, vendor details or delivery receipts and automatically creates the Vendor Bill transaction in NetSuite ready for approval.

AP Automation solutions can also have an element of machine learning, which is to say they get smarter over time as they learn and store data about specific vendors, invoice layouts and more. This means that it becomes much easier to use and is customised to the requirements of the business.

Why Do We Encourage NetSuite Users to Look Into Automating Accounts Payable?

AP Automation is one of the easiest solutions to calculate a finite ROI during the evaluation process. Because Accounts Payable is heavily reliant on human resources, calculating the cost savings is simple.

The Math

On average, a good AP clerk can code around 5 to 7 invoices per hour which works out to around 1500 invoices per month. However, when you include the administrative effort other than the bill data entry process this number comes down to around 4 invoices per hour.

Some examples include:

- Receiving invoice

- Matching to Purchase Orders

- Matching to Delivery Receipts

- Verifying GL impacts

- Resolving exceptions

- Correcting errors

- Generating and sending statements

- Processing payments

- Supplier admin maintenance

- Corresponding internally with other NetSuite users and with suppliers.

Benchmarking the average AP Clerk Salary at around $60,000 per annum plus overheads of around 15% the cost the total cost of that team member is $69,000 per annum.

The total number of work days (minus Annual Leave) is 235.

The number of invoices that can be processed in a work day, including all tasks from receiving the bill to processing the payment is 30.

This means the total capacity of a full time AP clerk is around 7000 invoices per year.

This puts the average cost of processing a bill at $9.85 per invoice.

Comparing the Cost of People Power to the Cost of Technology

Most AP Automation solutions, like Webexpenses have a price model that is linked to the volume of invoices that are being processed and in the overwhelming majority of cases this is a fraction of the cost of not embracing these solutions. Our clients have reported a total cost saving of 60% to 80% depending on the volume of invoices they receive in a month.

By calculating how many invoices you receive and doing some quick calculations, it’s easy to see how investing in technology starts to become a no brainer.

When considering a future state, where your business has scaled, and additional resources are needed to manage the manual processing of AP, it becomes clear to see that the benefits are cascading for a growing business.

There are numerous other costs that can also be included when evaluating AP automation, such as:

- Risk of fraud from team members.

- The cost of errors due to incorrect data entry.

- The cost of processing late payment discounts or accepting early payment discounts that you are not entitled to .

- There are also hidden costs involved with paper invoices.

- Cost of audits

Accounts Payable Tasks That Can Be Instantly Automated

Accounts Payable tasks that should be automated are ones that are either repetitive, time consuming or highly dependent on accuracy. These include:

Bill Receipt

Whether you receive supplier bills by email in digital format or paper invoices by mail, AP Automation tools have the technology to easily organise, sort and load the digital file for processing. Many also come with high volume scanning hardware which means even if you do receive paper invoices, getting them into a digital format is simplified.

Data Entry

Once the digital file is loaded into the AP solution, the OCR and ICR gets to work in reading the document and sorting relevant data ready for upload to NetSuite.

Invoice Matching

Once the transaction has been created in NetSuite, we can use pre-existing related transactions such as Purchase Orders and Delivery receipts to automatically link, and if needed, approve the invoice for payment based on a 3 way match or other thresholds that you decide.

GL Coding

Based on the rules you have set up in NetSuite, GL Coding becomes a system led process. NetSuite is very flexible in its set up when it comes to GL and there are a number of tools that mean manually coding transactions to specific GL codes is not necessary.

Workflows and Approvals

Once the bill has been entered and matched, NetSuite’s workflow and approval tools can kick in and route the transaction to the relevant approver.

What are the top benefits TeamBlueSky clients report after implementing AP Automation?

At a high level, our clients report immediate time savings as well as a reduction in costs of managing the AP department through a reduced headcount as well as minimisation of errors and corrections. However the benefits permeate beyond the finance department alone, with other departments in the businesses reporting improvements too.

Office Organisation

After moving to an AP Automation, clients report a massive reduction in paperwork as well as simplifying document storage by keeping a digital copy of the invoice in the NetSuite file cabinet.

Less Errors

We are all human and mistakes happen. However, a data entry error in the accounts payable department can cause massive headaches beyond the finance department. In most cases, multiple departments such as warehouse teams & procurement teams need to get involved to help with the resolution of errors. This can create unnecessary work and complexity in other departments and end up costing a business time and money.

Audits and Fraud

AP Automation technology, such as Webexpenses increases the security of your AP process by using technology to detect abnormalities and suspicious activity and alert users when this occurs. From an audit perspective, having all records and documents stored on the transaction makes auditing and reconciling easier and again increases the efficiency of the finance team as a whole.

Team Redeployment Into Higher Value Tasks

Whilst AP Automation software reduces the need for human resources to manually process bills, this doesn’t necessarily mean that these team members are let go. In most cases, these team members can be redeployed into higher value tasks such as AP Analysis or Supplier Performance reporting in order to further improve the full supply chain function rather than spending time doing repetitive tasks such as keying invoices.

AP Automation Evaluation & Selection Leading Practices

If you are considering AP Automation technology, there are some leading practices that you should consider to help guide your business through the evaluation and selection process. These include:

Getting Stakeholder Buy In

Change can often be a difficult process to manage, however gaining stakeholder buy-in throughout the process can drastically improve the rollout out of any new software solution and AP Automation is no different. There are usually many stakeholders involved in this area of finance including CFO, Financial Controller, AP Clerks, Supply Chain Managers and Analysts to name a few. By creating a project team that involves key people and subject matter experts from each of these areas you are empowering your workforce to actively contribute and take ownership of the evaluation and selection process. This not only increases the amount of internal knowledge that goes into the decision, but also helps to build champions throughout the organisation.

Choose the Right Leader

By identifying a Project Manager to lead the process, from evaluation through to implementation and go-live you are giving the project the best chance of success. The knowledge that is gathered throughout the evaluation and selection is vital during implementation and transitioning into go-live. Having a key leader to champion this will give consistency to the project and a clear line of communication regarding any ideas or concerns that team members may have.

Take a Phased Approach

Whilst automation is a powerful tool to increase efficiency of processes and effectiveness of team members, too much automation too quickly comes with its own set of risks. Most AP Automation offer a wide range of modules, features and functionalities however you should identify which areas are your highest priority and approach an implementation as a “first phase” with a view to continual improvement. This will help to make change management more approachable, streamline the impact on the day to day workloads of the AP team and give them time to understand the plan, learn new processes and implement them more easily.

Communicate Externally

In our experience, it is just as important to communicate with external stakeholders as it is to communicate internally to team members. Suppliers and vendors can also be impacted by the changes brought about by implementing AP automation solutions, so consider how it may affect them, communicate early and help them understand the benefit it may have, such as your goal to reduce average days vendor bills are outstanding.

Interested in learning more about AP Automation for NetSuite?

TeamBlueSky has partnered with Webexpenses to help more Australian NetSuite customers make AP Automation a key element of their Business Management Platform. Whether you are currently implementing or already live, our team of experts are here to help you with the evaluation of your AP Automation options, and implement a solution that will see you simplifying your AP departments processes and take advantage of the cost reductions that investing in automation has brought to so many of our clients.

Feel free to reach out for an obligation free discussion on hello@teambluesky.com.au or call us on 1300 174 382.

Interested In Learning More About Webexpenses?

Henry Sack

General Manager

With over 12 years of experience as a NetSuite implementation consultant, Henry Sack leads TeamBlueSky’s team of NetSuite and accounting experts in his role of General Manager.

TeamBlueSky is a leading Australian

NetSuite Alliance Partner whose mission is to provide critical

NetSuite BPO and

Payroll services to NetSuite clients who are wanting to simplify their

back office processes and partner with a leading

NetSuite administration expert.

TeamBlueSky have also partnered with global Suite Developer Network partners to offer local solutioning, implementation and support services for global NetSuite SuiteApps.