Understanding Payroll Compliance in Australia: A Comprehensive Guide

Payroll compliance is the adherence to laws, regulations, and practices related to paying employees. In Australia, compliance is essential to avoid legal issues, maintain the company’s reputation, and ensure fair treatment of employees, which can foster higher morale and productivity.

In this article, we will explore the relevant Australian payroll laws that apply to all businesses, the obligations surrounding paying your employees wages, salaries and superannuation, as well as compliance guidelines for withholding and remitting tax to the ATO. We will also cover the types of record-keeping and reporting requirements that businesses need to maintain, including new requirements such as Annualised Salary Reporting. Finally, we will explore how payroll software supports businesses by providing an automated and integrated technology platform to calculate, process, cross-check, and remit payroll details to the relevant government bodies.

Understanding Australian Payroll Laws

Comprehending the payroll’ legal landscape’ is pivotal to achieving compliance. In Australia, several key laws govern payroll and employment-related matters. Let’s explore three important Legal Acts that employers must familiarise themselves with:

Fair Work Act

The Fair Work Act 2009 is a central piece of legislation that encompasses a broad range of employment issues. It establishes minimum requirements for employee compensation and working conditions for a wide range of Modern Awards. Under this act, employers must adhere to the National Employment Standards (NES), which cover various aspects such as maximum weekly hours, annual leave, personal leave, public holidays, and more. The Fair Work Act also sets out provisions for unfair dismissal, redundancy, workplace bullying, and industrial action.

Income Tax Assessment Act

The Income Tax Assessment Act 1997 (Cth) governs the calculation of taxes and permissible deductions. It provides guidelines on how employers should withhold income taxes from their employee’s wages and remit them to the Australian Tax Office (ATO). Employers need to accurately calculate the amount of tax to withhold based on employees’ income levels and relevant tax brackets. They must also consider various deductions, such as work-related expenses, to ensure the correct amount of tax is withheld. Compliance with the Income Tax Assessment Act is crucial to avoid underpaying or overpaying taxes, both of which can lead to legal and financial implications. It’s also worth considering that your business may also be subject to Payroll Tax, which varies by state. If this applies to you, ensure your payroll team has a solid understanding of the requirements in any state where you have employees normally residing.

Superannuation Guarantee

The Superannuation Guarantee (Administration) Act 1992 is a critical aspect of payroll compliance in Australia. It mandates that employers contribute a percentage of their employees’ earnings to a compliant superannuation fund. Employers must ensure that they calculate and make the correct superannuation contributions on behalf of their eligible employees. They must also meet the deadlines for making these contributions, which are generally monthly or quarterly. Non-compliance with the Superannuation Guarantee can result in penalties and additional liabilities for a business owner. Therefore, it is essential for employers to have a good understanding of the contribution rates, deadlines, and compliance requirements set out by the SGA.

Payment Obligations

Payment obligations are crucial in ensuring that employees receive their rightful compensation. Let’s explore three key aspects of payment obligations in Australian payroll compliance.

Minimum Wage Standards

Employers in Australia are required to pay their employees at least the federal minimum wage. The minimum wage is set by the Fair Work Commission and is reviewed annually. It serves as a baseline to ensure that employees receive fair compensation for their work. However, it’s important to note that various awards and agreements may dictate different minimum wages for different occupations or industries. These awards and agreements provide additional provisions and minimum entitlements specific to certain roles or sectors. Employers must be aware of the applicable minimum wage standards and ensure that they comply with the appropriate rates for their employees’ classifications.

Overtime and Penalty Rates

When employees work beyond their standard hours or during evenings, weekends, or public holidays, they may be entitled to overtime and penalty rates. Overtime refers to the additional pay employees receive for working extra hours, typically beyond their agreed-upon full-time or part-time hours. Penalty rates, on the other hand, are additional payments for working during specific non-standard hours, such as evenings, weekends, or public holidays. These rates are often higher than the standard hourly rate to compensate employees for the inconvenience or sacrifice of working during those times. Employers must accurately calculate and apply the appropriate rates to ensure that employees receive the correct compensation for their overtime and work during non-standard hours.

Leave Entitlements

Leave entitlements, including annual leave, sick leave, and maternity leave, are critical components of payroll compliance. Employees have the right to take time off for various reasons, such as personal illness, annual vacations, or parental responsibilities. Employers must be aware of the specific leave entitlements outlined in the relevant legislation, awards, and employment contracts. It’s essential to accurately track and manage employees’ leave balances, ensuring that they have access to the leave they are entitled to when needed. Compliance with leave entitlements involves understanding the minimum amounts of leave employees are entitled to, the rules for requesting and approving leave, and any additional entitlements that may apply to specific circumstances, such as parental leave or long service leave.

Taxation and Superannuation

Understanding tax regulations and superannuation requirements is essential for employers to maintain compliance with tax obligations. Let’s explore three key aspects of taxation and superannuation in Australian payroll compliance.

Withholding Taxes

Employers have the responsibility to withhold income taxes from their employee’s pay and remit them to the Australian Tax Office (ATO). Withholding taxes involves deducting the correct amount of tax from employees’ wages based on their income and the applicable tax brackets. Employers must accurately calculate the amount of tax to withhold, taking into account factors such as tax-free thresholds, tax offsets, and any additional contributions, such as salary sacrifice arrangements. It is crucial to stay updated on tax rates and any changes made by the ATO. Compliance with withholding taxes not only ensures that employees meet their tax obligations but also helps employers fulfil their responsibilities as tax collectors on behalf of the government.

Superannuation Contributions

In addition to withholding taxes, employers are obligated to make superannuation contributions on behalf of their employees. Superannuation is a system in Australia that encourages individuals to save for retirement. Employers must contribute a percentage of their employees’ ordinary time earnings to a complying superannuation fund. The current minimum contribution rate is 10% of an employee’s earnings. Compliance involves calculating and making the correct contributions on time and ensuring that they are paid into compliant superannuation funds. Employers must also provide employees with accurate information about their superannuation contributions on their payslips.

Fringe Benefits Tax

Certain benefits provided to employees, in addition to salaries, such as company cars, housing allowances, or non-cash rewards, may be subject to the Fringe Benefits Tax (FBT). The FBT is a tax paid by employers on the value of these fringe benefits provided to their employees. Employers need to understand which benefits are subject to FBT, calculate the taxable value of those benefits, and report them to the Tax Office. Compliance with FBT involves maintaining accurate records, understanding FBT exemptions and concessions, and fulfilling reporting and payment obligations. Failure to comply with FBT requirements can result in penalties and additional tax liabilities for employers.

Keeping Records

Keeping meticulous and accurate payroll records is not only a legal requirement but also a best practice for employers. Let’s look deeper into two important aspects of record-keeping in Australian payroll compliance.

Annualised Salary Reporting Requirements

Since 1st March 2021, employers face harsh penalties for failing to comply with annualised wage agreements across 18 different awards, including:

- Banking, Finance and Insurance Award

- Broadcasting Award

- Clerks Award

- Contract Call Centres Award

- Hydrocarbons Industry (Upstream) Award

- Legal Award

- Local Government Award

- Manufacturing Award

- Mining Award

- Oil Refining and Manufacturing Award

- Pharmacy Award

- Rail Award

- Salt Award

- Telecommunications Award

- Water Award

- Wool Award

Businesses that have employees who are covered by these industrial instruments will need to ensure they consider additional compliance requirements. With the new directive in place, employers are obligated to undertake an annual reconciliation of their entire workforce’s annualised wage agreement and must ensure that the total payments made to an employee are, at minimum, aligned with what they would have earned under the modern award.

These new rules mean most employers will need to significantly improve their payroll record keeping, including time sheets, overtime, meal breaks and other allowances, in order to be able to report back to the Fair Work Commission and prove employees have been remunerated correctly and that there are no underpayments.

Pay Slips and Employment Records

In Australia, employers are legally obligated to provide employees with payslips within one working day of their payday. Pay slips contain crucial information such as gross wages, tax withheld, superannuation contributions, and any deductions or allowances. They also include important details like the pay period, the employee’s name, and the employer’s name. Pay slips help employees understand their earnings and deductions, ensuring transparency and providing a clear breakdown of their pay.

Employers must retain employee records, including pay slips, for a minimum of seven years. These records serve as evidence of compliance with payroll obligations, employment contracts, and applicable legislation. They may be required during audits, legal proceedings, or when responding to employee inquiries or disputes.

Reporting Obligations

Reporting obligations are essential for employers to fulfil their responsibilities and provide accurate information to relevant authorities. Let’s explore three significant reporting obligations in Australian payroll compliance.

Single Touch Payroll (STP)

Single Touch Payroll is a streamlined reporting arrangement introduced by the Australian Taxation Office (ATO). Under STP, employers are required to report salary, wages, taxes withheld, and superannuation information directly to the ATO at the same time or before making payroll payments. This real-time reporting enables the ATO to have up-to-date data on employees’ earnings and tax liabilities. Employers must adopt an STP-enabled payroll solution to comply with this reporting requirement. STP reduces the administrative burden of separate reporting processes and facilitates efficient communication between employers and the ATO.

PAYG Withholding

The PAYG (Pay As You Go) withholding system is a mechanism through which employers withhold money from payments made to employees, contractors, and other businesses. The withheld amounts represent the employees’ estimated tax obligations, which employers are responsible for remitting to the ATO. Employers must accurately calculate the amount of tax to withhold based on employees’ earnings, deductions, and any applicable offsets. The withheld amounts must be reported and remitted to the ATO by specific due dates. Compliance with PAYG withholding ensures that employees’ tax obligations are met and that employers fulfil their tax remittance responsibilities.

Superannuation Payments

Employers have reporting obligations regarding superannuation contributions made on behalf of their employees. Superannuation payments must be made to compliant superannuation funds by the required due dates, and employers must report the contributions to the ATO. Reporting includes providing accurate details of the contributions made, such as the amount and the employee’s superannuation fund details. Timely and accurate reporting of superannuation contributions ensures compliance with the Superannuation Guarantee legislation and assists in the proper allocation of contributions to employees’ retirement savings.

Audits and Inspections

Audits and inspections play a crucial role in ensuring compliance with payroll regulations in Australia. Let’s explore two significant types of audits that businesses may face.

Fair Work Ombudsman Audits

The Fair Work Ombudsman (FWO) is responsible for promoting compliance with the Fair Work Act and other workplace laws in Australia. The FWO has the authority to conduct audits and investigations to ensure that businesses comply with their obligations under the Fair Work Act. These audits aim to assess if employers are adhering to minimum wage requirements, penalty rates, leave entitlements, record-keeping obligations, and other provisions outlined in the Fair Work Act.

To prepare for potential FWO audits, it is crucial for businesses to regularly review their compliance practices. This includes maintaining accurate and up-to-date employment records, ensuring proper payment of wages and entitlements, and staying informed about any changes to employment laws. Proactive compliance measures (such as conducting regular internal audits and seeking professional advice) can help businesses identify and rectify any non-compliance issues before facing FWO audits. By being prepared and compliant, businesses can mitigate the risk of penalties and reputational damage resulting from non-compliance with the Fair Work Act.

Tax Office Audits

The Australian Tax Office (ATO) can conduct audits to assess the compliance of businesses with their taxation obligations, particularly in relation to PAYG withholding and superannuation payments. These audits focus on ensuring that employers accurately withhold and remit taxes from employee wages, report superannuation contributions correctly, and meet other tax obligations.

Staying compliant with PAYG withholding and superannuation requirements is essential to minimise the risk of ATO audits and potential penalties. Employers must accurately calculate and remit the correct amounts of tax and superannuation contributions on time. This involves maintaining accurate payroll records, implementing robust payroll systems, and staying updated with any changes to tax and superannuation legislation. By conducting regular internal reviews and seeking professional advice when needed, businesses can enhance their compliance efforts and mitigate the risk of non-compliance during ATO audits.

Penalties for Non-Compliance

Non-compliance with payroll regulations can result in various penalties, sanctions, and reputational damage for businesses. Understanding the consequences and adhering to the laws is vital for the smooth operation of business.

Fines and Penalties

Government agencies, such as the Fair Work Ombudsman (FWO) and the Australian Tax Office (ATO), have the authority to impose fines and penalties on businesses that fail to comply with payroll regulations. The exact penalties vary depending on the nature and severity of the non-compliance. For instance, under the Fair Work Act, penalties for breaching minimum wage requirements, failing to pay overtime or penalty rates, or not providing proper leave entitlements can result in significant fines for your firm.

Non-compliance with taxation obligations, including PAYG withholding and superannuation contributions, can also lead to additional compounding penalties imposed by the ATO. These penalties may include monetary fines, interest charges, and administrative penalties based on the amount and duration of non-compliance.

Sanctions and Legal Consequences

In addition to fines and penalties, non-compliance with payroll regulations can lead to legal consequences and sanctions. The Fair Work Ombudsman has the power to initiate legal action against any firm found to be in breach of the Fair Work Act. This can result in legal proceedings, court orders, and additional financial liabilities.

Employers who fail to meet their superannuation obligations, such as making required contributions or reporting contributions accurately, may face legal action and sanctions from regulatory bodies responsible for overseeing superannuation compliance.

Reputational Damage

Non-compliance with payroll regulations can have significant reputational consequences for businesses. News of non-compliance, wage theft, or unfair treatment of employees can quickly spread through media and social channels like wildfire, tarnishing a business’s reputation. This can lead to a loss of customer trust, negative public relations, and potential damage to relationships with stakeholders, including employees, suppliers, business partners and investors.

Recovering from reputational damage can be challenging and time-consuming. It may require significant efforts to rebuild trust and repair the business’s image in the eyes of customers, employees, and the wider community.

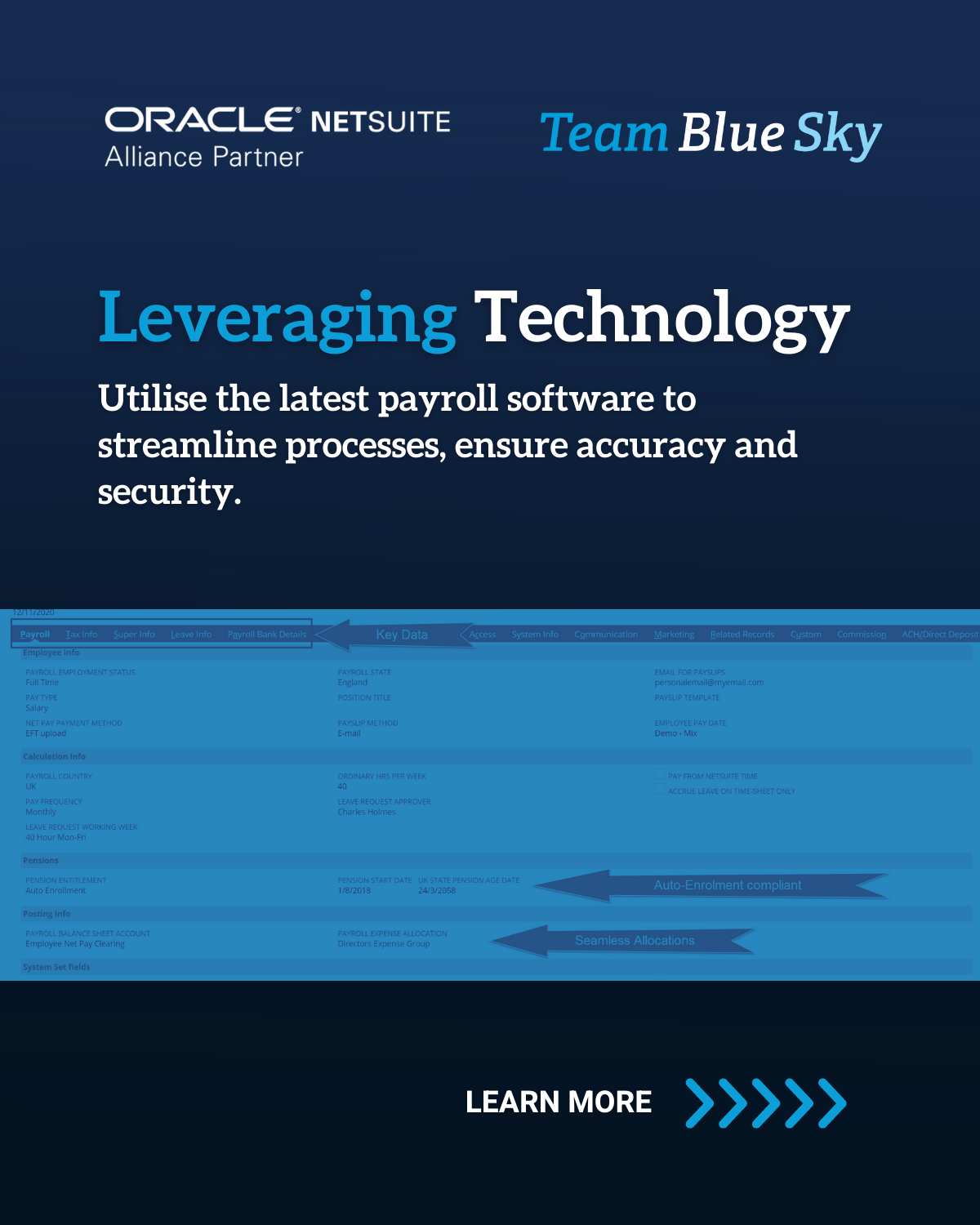

Leveraging Technology

Utilising technology, such as

cloud payroll software, can greatly

streamline the payroll process and contribute to ensuring compliance with payroll regulations. Let’s explore two key aspects of leveraging technology in payroll management.

Wrapping Up

In conclusion, understanding and complying with payroll compliance in Australia is essential for businesses of all sizes and industries. While it may seem daunting and complex, the process can be broken down into manageable steps. By staying informed on the latest developments, adhering to regulations, and utilising payroll software that simplifies the process, businesses can ensure they remain compliant with Australian tax laws.

Additionally, businesses should prioritise data security and implement measures that protect employee data from unauthorised access and breaches. With the right tools and processes in place, businesses can ensure compliance while reducing time, effort, and costs associated with payroll management.

Henry Sack

General Manager

With over 12 years of experience as a NetSuite implementation consultant, Henry Sack leads TeamBlueSky’s team of NetSuite and accounting experts in his role of General Manager.

TeamBlueSky is a leading Australian

NetSuite Alliance Partner whose mission is to provide critical

NetSuite BPO and

Payroll services to NetSuite clients who are wanting to simplify their

back office processes and partner with a leading

NetSuite administration expert.

TeamBlueSky have also partnered with global Suite Developer Network partners to offer local solutioning, implementation and support services for global NetSuite SuiteApps.