How Netgain is Helping Australian Businesses Adhere to the New ASC 842/IFRS16 Lease Accounting Standards

In January 2022, new rules took effect impacting how Australian businesses of all sizes need to account for leases. In Australia, commercially leased equipment has a combined total of $44 billion each year. Commercial equipment leases can be broken down into various subcategories of lease including:

- Finance Lease

- Operating Lease

- Commercial Hire Purchase

- Chattel Loan/Mortgage

Each of these types of leases carries nuances as to how we must account for their acquisition, periodical lease payments and transfer into full ownership.

What is a Finance Lease?

A finance lease is a contract that conveys the right to use an asset for a fixed period in return for periodic payments. The lessee (user) enjoys most of the benefits and risks associated with owning the asset, while the lessor retains ownership of the asset. At the end of the lease term, the lessee usually has the option of either returning the asset to the lessor or purchasing it from the lessor.

Finance leases are commonly used for equipment, machinery and vehicles. In Australia, a lease is treated as a finance lease if any one of the following is true:

- The lessee has the option to purchase the leased asset at a price that is significantly lower than the fair market value of the asset at the time the option is exercisable

- The lease term is for more than 75% of the useful life of the leased asset

- The present value of the lease payments is more than 90% of the fair market value of the leased asset at the time the lease agreement is made

What is an Operating Lease?

An operating lease is a contract that conveys the right to use an asset for a fixed period in return for periodic payments. The lessee does not have the option to purchase the leased asset at the end of the lease term.

Operating leases are also commonly used for equipment, machinery and vehicles. In Australia, a lease is treated as an operating lease if any one of the following is true:

- The lessee has no option to purchase the leased asset at the end of the lease term

- The lease term is for less than 75% of the useful life of the leased asset

- The present value of the lease payments is less than 90% of the fair market value of the leased asset at the time the lease agreement is made

What is a Chattel Loan/Mortgage?

A chattel loan, also known as a chattel mortgage, is a type of secured loan where the asset being financed is used as collateral. The lender has a security interest in the asset until the loan is repaid in full.

A chattel mortgage can also be used for equipment, machinery and vehicles. In Australia, a lease is treated as a chattel mortgage if any one of the following is true:

- The financed asset is used as security for the loan

- The loan amount is more than 80% of the fair market value of the asset at the time the loan agreement is made

- The lease term is for more than 75% of the useful life of the financed asset

What is a CHP Lease?

A CHP lease, also known as a capital hire purchase lease, is a type of operating lease where the lessee has the option to purchase the leased asset at the end of the lease term for a predetermined price.

In Australia, a lease is treated as a CHP lease if any one of the following is true:

- The lessee has the option to purchase the leased asset at a price that is significantly lower than the fair market value of the asset at the time the option is exercisable

- The lease term is for more than 75% of the useful life of the leased asset

- The present value of the lease payments is more than 90% of the fair market value of the leased asset at the time the lease agreement is made

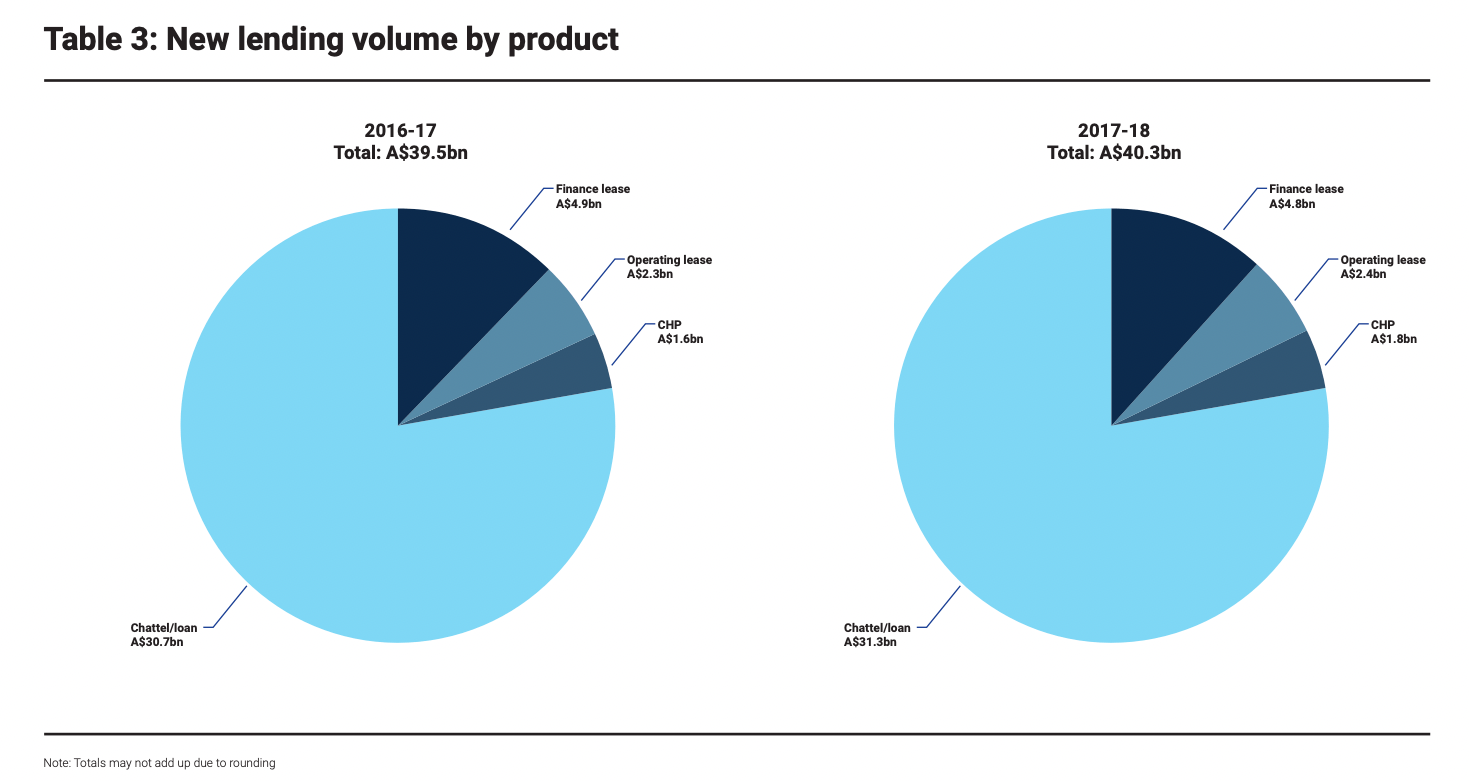

Breakdown of Lease Types in Australia

In Australia, Chattel Loans and Mortgages make up around 75% of total leased assets. Finance leases come in second place at around 12.5% followed by operating leases at 8% and CHP Leases at 4.5%

What are the benefits of leasing?

There are several benefits of leasing, including:

- You can acquire assets without having to immediately come up with the full purchase price

- You can spread the cost of acquiring an asset over a number of years, which can be more manageable for your budget

- Leasing may be tax deductible, depending on your circumstances

- You can upgrade or downgrade your leased asset at any time during the lease term

- The leased asset is always covered by a warranty

What are the risks of leasing?

There are also a few risks associated with leasing, including:

- If you default on your lease payments, the lessor has the right to take possession of the leased asset

- If the lessor goes bankrupt, you may not be able to recover your leased asset

- The lease payments may be more expensive than the cost of purchasing the leased asset outright

- You may not be able to use the leased asset for your own personal purposes

What are some key considerations when accounting for leases?

- When accounting for leases, you must classify them as either a finance lease, an operating lease or a chattel mortgage lease

- You must also record the lease payments as an expense in your income statement, and the asset and liability for the lease on your balance sheet

- Leases can have a significant impact on your financial statements, so it's important to understand them fully before signing any agreements

- The financial health of your business should also be closely monitored if your company leases or rents assets, as the fiscal impact of maintaining these leases is not as transparent as buying assets outright

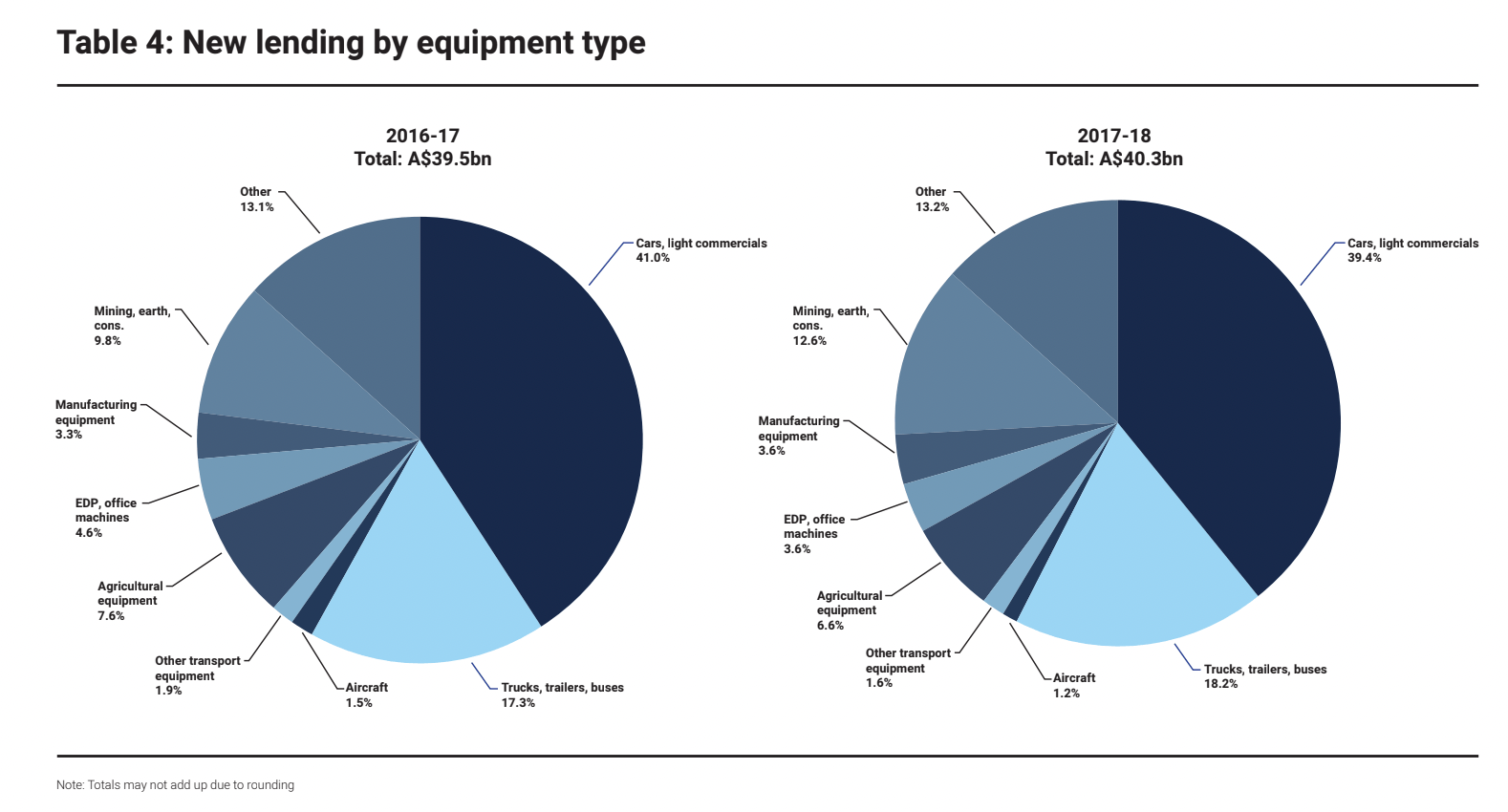

What types of assets are businesses leasing?

In Australia, leasing equipment is common practice and is considered a mature industry, when compared to more modern types of finance, such as short term buy now pay later lending options.

In 2022, businesses are able to lease a wide range of equipment, including but not limited to:

- Heavy Equipment and Machinery - e.g. Mining, earth moving and construction equipment.

- Manufacturing Equipment - e.g. CNC Machines, Laser Cutting Machines, Metal Bending Technology, 3D Printing Equipment

- Electronic Data Processing - e.g. Office Equipment, Printers, Computers, Servers

- Agricultural Equipment - eg. Harvesters, Irrigation Systems, Tractors

- Heavy Transport Equipment - e.g. Trucks, Trailers, Busses

- Aircraft - Helicopters, Light Aviation Craft, Drones

- Light Vehicle - Cars, Utes, Light Commercial Vehicles

Lease Accounting Standards: Changes to ASC 842/IFRS16

Topic 822 was the Financial Accounting Standards Board's amendment to lease accounting requirements. Thoroughly understanding Topic 822 is critical to implementing the new standard. The following are key points:

- A lessee should recognize a lease liability and a right-of-use asset for all leases with a term of more than 12 months

- For leases with a term of 12 months or less, a lessee should recognize a lease liability only if the "lease" is reasonably certain to be exercised

- The lease liability should be measured at the present value of the remaining lease payments

- Tangible assets should be classified as Class 3, and intangible assets should be classified as Class 4

- Rights-of-use assets and lease liabilities will generally be measured at the lower of cost or fair value

- The classification of a lease as a finance lease, an operating lease, or a chattel mortgage lease will affect the accounting treatment

The new rules require lessees to list ROU assets as well as liabilities in accounts for almost all leases. In preparation for ASC 842/IFRS16 preparation, it is important to understand the key terms of lease accounting.

How to plan for ASC 842/IFRS16 changes in lease accounting rules

ASC 842/IFRS16 is designed to improve and simplify the accounting for leasing in different organisations, however there are some complexities to the new process. Businesses may need to review their current leasing agreements in order to plan for the move.

Lessees should identify all leases and assess the impact of the new standard

A review of internal controls related to leases is warranted. Lease accounting software should be evaluated and updated as needed. The following are key steps for companies to take in order to prepare for the changes in lease accounting rules:

- Assess your current leasing agreements and determine which leases will be impacted by ASC 842/IFRS16

- Review your internal controls related to leases and update as needed

- Evaluate lease accounting software and update as needed

- Train accounting and non-accounting staff on the new standard

- Communicate with key stakeholders about the changes in lease accounting rules and how they will impact your business

Key Impacts

- Leases will now be accounted for on the balance sheet

- Classification of leases will impact financial statements

- Rights of use (ROU) assets will need to be disclosed

- Prepare for changes in your lease accounting processes, including data collection and system updates.

- Consider system driven automation to ensure compliance to the new Lease Accounting Standards

Accounting for Lessees and Leases: Definition and Classification

The FASB issued a new lease accounting standard, marking a significant and lasting change in accounting principles we must apply as Australian businesses who account for leases. This document is a challenge for both business and auditors. Talking through the definitions and classifications of who a lessee is, what a lease is and how leases are classified will help to make the following concepts more understandable.

The definition of a lease is: "A contract, or part of a contract, that conveys the right to use an asset for a period of time in return for consideration."

What is a Lease?

A lease, as defined earlier, is a contract that conveys the right to use an asset in return for consideration. The key part of

Who is a Lessee?

The lessee is the entity who has the right to use the leased asset. In our example, the organisation is the lessee.

Who is a Lessor?

The lessor is the entity who owns the leased asset and conveys the right to use it to the lessee.

An Example

An organisation enters into a contract with a third party whereby the third party allows the organisation to use their office building for 12 months in return for $10,000. The contract is therefore a lease as it conveys the right to use an asset (the office building) for a period of time greater than 12 months.

NetSuite + Netgain Can Help Your Company Comply With the New Lease Accounting Standards

These new lease accounting regulations may initially cause some problems. Accounting departments that are efficient in adopting this new standard in Lease Accounting will be recognised for their reliability in compliance. Adhering to the new rules is not difficult to achieve if you have the right control systems in place. NetSuite + Netgain can be used to manage a large volume of leases and ensure that the new standards are applied when it comes to managing lease initiation, periodic payment processing and lease closure. NetSuite's integrated financial management solutions allow businesses to secure consolidated financial assets while expediting financial transactions.

What is NetLease?

NetLease, by Netgain, offers a best-in-class solution with everything you need to account for leases in your business without the complexity and risk of an external application. With embedded lease accounting in NetSuite, you can focus on what you do best: running your business. NetLease is a comprehensive solution that automates the entire process of lease accounting, from creating leases to recording lease payments and generating financial statements.

Key features of NetLease include:

- Automatic lease accounting and reporting in compliance with US GAAP, IFRS, and other global standards

- Real-time visibility into your company’s leasing activity across all legal entities and geographies

- Seamless integration with NetSuite’s comprehensive ERP and CRM functionality

- Fast, easy implementation with no customisation required

- NetLease is the only lease accounting solution designed and built by NetSuite, the world’s leading provider of cloud-based business management solutions

Impacts of Implementing NetLease by Netgain

Compliant

Achieve compliance with the new lease accounting standards using NetLease by Netgain. This best-in-class solution automates the entire process of lease accounting, from creating leases to recording lease payments and generating financial statements.

Automated

Lease accounting and reporting is fully automated in NetLease, ensuring compliance with global standards. With real-time visibility into your leasing activity across all legal entities and geographies, you can manage your portfolio more effectively.

Audit-ready

Auditors are increasingly requiring companies to adopt the new ASC 842/IFRS16 lease accounting standards. With NetLease by Netgain, you can automate the entire process of lease accounting and reporting, ensuring compliance with global standards. This best-in-class solution provides you with the transparency and assurance you need to reassure your stakeholders.

Affordable

NetLease is an affordable solution, with no customisation required. It integrates seamlessly with NetSuite’s comprehensive ERP and CRM functionality, making it the most cost-effective way to achieve compliance with new lease accounting standards.

Fast Implementation

NetLease is fast and easy to implement, with no customisation required. It can be up and running within a week, so you can get on with the business of running your company.

Embedded

With NetLease, Lease accounting automation is embedded in NetSuite, providing you with the comprehensive functionality you need to manage your leasing activity. With no additional software required, you can rely on NetSuite to automate the entire process of lease accounting and reporting.

Trouble-free

NetLease is a trouble-free solution, with no need for customisation. It integrates seamlessly with NetSuite’s comprehensive ERP and CRM functionality, making it the most cost-effective way to achieve compliance with new lease accounting standards.

Time-Saving

NetLease saves you time and money with its automated lease accounting processing and reporting. It integrates seamlessly with NetSuite’s comprehensive ERP and CRM functionality, making it the most cost-effective way to achieve compliance with new lease accounting standards.

Secure

NetLease is a secure solution, with encryption and authentication features that keep your data safe and confidential. With NetLease by Netgain, you can be confident that your data is protected at all times.

How do NetLease and Netgain solve the complexities in ASC 842/IFRS16 Lease Accounting Compliance?

As the world’s leading provider of cloud-based business management solutions, NetSuite provides a solid financial platform, and meets most of the needs of businesses of all sizes and industries. However, when it comes to Lease accounting, NetSuite has minimal functionality to manage and automate this complex accounting task.

That’s why Netgain developed NetLease, a comprehensive lease accounting solution that automates the entire process of lease accounting, from creating leases to recording lease payments and generating financial statements.

In Conclusion

NetLease by Netgain, is a comprehensive lease accounting solution that automates the entire process of lease accounting, from creating leases to recording lease payments and generating financial statements. With no additional software required, you can rely on NetSuite to automate the entire process of leasing activity and reporting with NetLease by Netgain's embedded functionality. Lease accounting is an important aspect of any company's financials, and the new ASC 842/IFRS16 standard presents some challenges for businesses to adapt to. By understanding the key points of the standard and taking the necessary steps for implementation, as well as partnering with Lease Accounting software experts like TeamBlueSky and Netgain, companies can make the switch as smooth as possible.

If you are interested in learning more about how TeamBlueSky and Netgain can help your business comply with the new lease accounting standards, please contact us for a free consultation.

Henry Sack

General Manager

With over 12 years of experience as a NetSuite implementation consultant, Henry Sack leads TeamBlueSky’s team of NetSuite and accounting experts in his role of General Manager.

TeamBlueSky is a leading Australian

NetSuite Alliance Partner whose mission is to provide critical

NetSuite BPO and

Payroll services to NetSuite clients who are wanting to simplify their

back office processes and partner with a leading

NetSuite administration expert.

TeamBlueSky have also partnered with global Suite Developer Network partners to offer local solutioning, implementation and support services for global NetSuite SuiteApps.