Big Business on Notice as Major Changes to Payment Time Reporting Act Help Small Businesses to Get Paid On Time

The Australian Government is implementing major changes to the Payment Time Reporting Scheme. These changes have been designed to help small businesses to get paid on time and limits how long large businesses and enterprises can take to make payments, regardless of invoice terms.

With the new scheme in place, businesses with a turnover of more than $100 million will now need to report publicly on invoice details from small businesses including due date, payment term and date of actual payment. The scheme is designed to provide transparency into the payment performance of major corporations and some government departments, and encourage these organisations to pay their small businesses suppliers on time.

This is welcome news to many small businesses owners as cash flow in a small business is one of the most important factors determining their success, especially in the early stages of trading. This also empowers small businesses to make informed decisions about who they do business with as well as helps the public to make ethical decisions about the organisations they choose to purchase from.

“Late payments have a significant impact on small business cash flow and inhibit the ability of a firm to invest, grow and employ,” Minister Cash said.

“Shining a light on large business payment performance will lead to fairer and faster payments for Australia’s 3.5 million small and family businesses. Bad payers won’t be able to hide, as this Scheme will expose their poor practices”.

Definition of a Small Business

For the purposes of this legislation, a Small Business defined as any business, whether providing goods or services whose turnover is less than $10 million dollars in the previous 12 month period.

Accessing the Small Business Identification Tool

Enterprises who are required to report under the new scheme can use the Small Business Identification (SBI) tool to identify their small business suppliers. The SBI tool is not a publicly available service.

As a small business, you can opt out of being identified by the SBI tool. If you opt out, large businesses will not report on their payment times and terms to your business.

You can access the SBI Tool here.

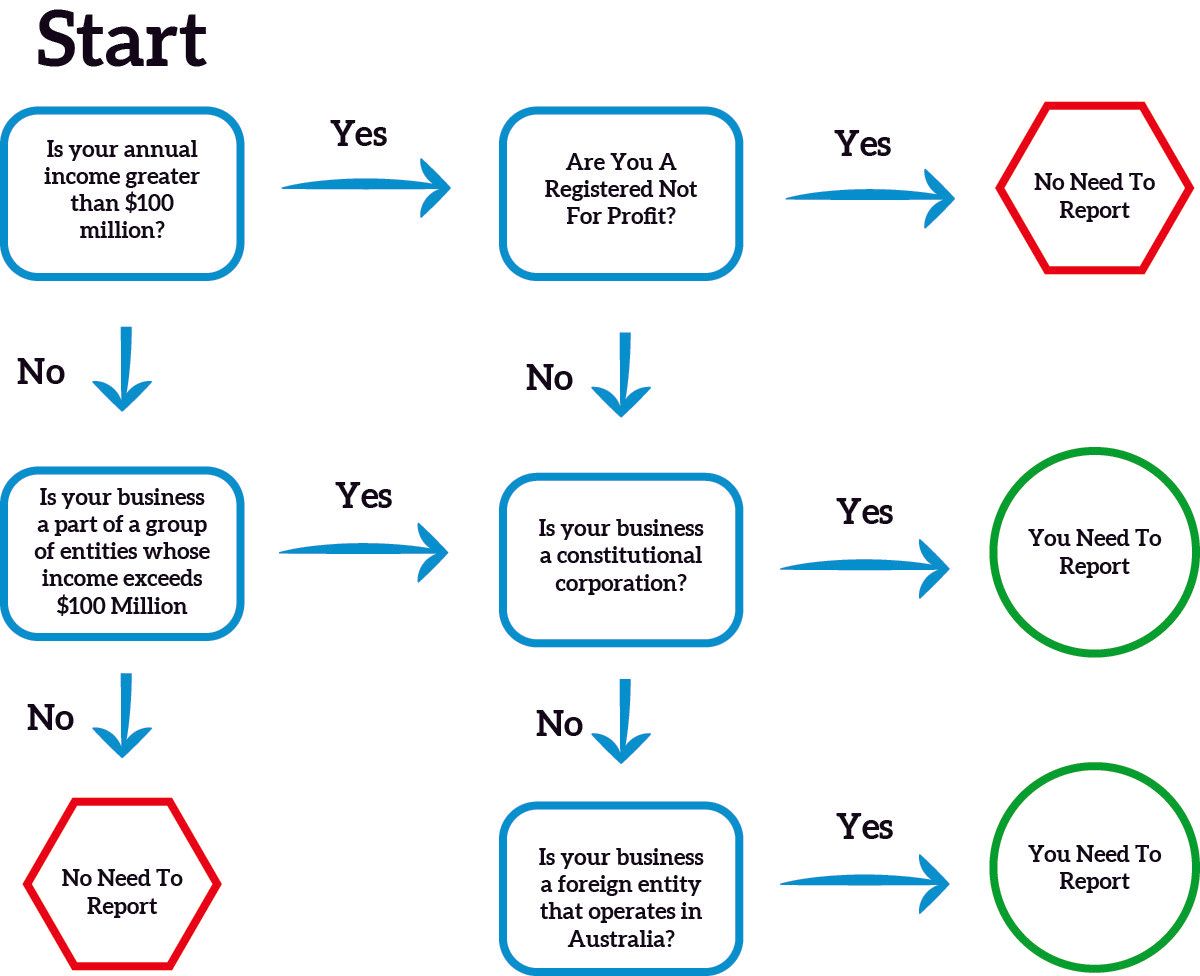

Definition of a Reporting Entity

A Reporting Entity is a large Australian business or organisation (including a business run by a foreign company or a corporate government entity) that:

- has an gross income of $100 million or more for the previous financial year; or

- is a 'controlling corporation' of a group of companies that has a combined group revenue of at least $100 million for the previous financial year; or

- is a member of a group with $100 million combined income and has itself an income of at least $10 million for the previous financial year; or

- voluntarily elects to report

So What Needs to be Reported?

Reporting entities are now required to report on payment performance to any business who meets the criteria of the definition of a “small business” for the purposes of this programme. This information will need to be collected over a period of 6 months, and submitted no later than 3 months after the end of the 6 month period. That means for most reporting entities, this information will be due by no later than September 30, 2021.

The information that will need to be reported includes:

- The shortest and longest standard payment periods as well as any changes to these periods during the course of the reporting period

- The proportion of small business invoices paid within 21 days, 21-30 days, 31-60 days and more than 60 days

- Details of any payments made on behalf of the company by a parent entity

Other information that will also need to be reported include:

- Entity name and ABN

- Entity’s controlling corporation name and ABN

- Entity’s head entity name and ABN

- Entity’s primary industry

- Reporting period

- Details of the person who submitted the report

- Approver of the report

- Entity’s principal governing body

- A declaration by a responsible member

- Standard payment periods to all suppliers

- Small business invoices paid

- Small business procurement

- Use of supply chain finance

- Small business invoices

- Small business practices or arrangements

- Notifiable events

- Additional information

Consequences of Non-Compliance

Big businesses could face fines of up to $73,500 if they fail to comply with or give false or misleading information in their reports. Also, the names of non-compliant entities will be made public. This information will be available to small business owners and consumers through the Payment Times Report Register.

Are You Ready?

TeamBlueSky is working with our clients to develop a NetSuite native solution to help with identifying small businesses through the Small Business Identification Tool, capture relevant and reportable payment performance data and streamline the reporting of this information back to the Payment Time Reporting Portal through a simple NetSuite CSV export.

If you are interested in learning more about the scheme, what you need to do to comply or how we are solving the issue for NetSuite clients, feel free to reach out for a discussion.

Henry Sack

General Manager

With over 12 years of experience as a NetSuite implementation consultant, Henry Sack leads TeamBlueSky’s team of NetSuite and accounting experts in his role of General Manager.

TeamBlueSky is a leading Australian

NetSuite Alliance Partner whose mission is to provide critical

NetSuite BPO and

Payroll services to NetSuite clients who are wanting to simplify their

back office processes and partner with a leading

NetSuite administration expert.

TeamBlueSky have also partnered with global Suite Developer Network partners to offer local solutioning, implementation and support services for global NetSuite SuiteApps.